Business Interruption Lawyers

Business interruption insurance is put in place to protect you from loss of income when there is a direct physical loss or damage to a covered property. But this present COVID-19 crisis has seen how insurance companies are trying everything in their power to label the effects of this pandemic as business interruption exclusions — or severely underpay — business interruption insurance claims. This is where our team of dedicated attorneys can help hold the insurance companies accountable.

Home » Insurance Dispute Lawyers » Business Interruption Lawyers

Filing a business interruption claim is a lengthy process. The right representation for your loss of business claim can make all of the difference. If you have had your loss of business claim denied, then you owe it to yourself to contact the business interruption attorneys Farah & Farah today. Get your free, no-obligation case review now!

What is a Business Interruption Claim

The success of a modern business requires a lot of moving parts. Unexpected accidents, natural disasters, or economic setbacks can have huge ripple effects on a business. Any interruption of business can lead to job loss, wage reduction, and closure.

Some common examples of business interruptions include:

- Natural disasters like winds, hurricane, tornadoes, lightning, and severe weather

- Government intervention

- Vandalism and theft

- Fires and explosions

- Objects falling

- Power loss

- Disruptions in the supply chain

- Breakdown of equipment

Business Interruption Insurance Claim Denial

Having business interruption insurance should protect you from the forced closure of your business. Unfortunately, an insurance agency is in the business of making money. That means that they may try to deny your claim to maintain their bottom line. You shouldn’t have to suffer because of things outside of your control. When fire, natural disaster, or power loss cause interruptions, businesses can no longer serve the community. Your business income insurance should not be a roadblock to your success.

Likewise, COVID-19 has shuttered the doors of many businesses. While insurance companies argue that a pandemic doesn’t qualify as a business interruption, we beg to differ. There is a direct throughline between government directives for shelter-in-place and social distancing and a widespread revenue loss.

This fight against business interruption claim denial is something our team has taken on to help the multitudes of small business owners in our area that are desperately hurting right now and who thought they had insurance to cover losses such as these. When your insurance company doesn’t present a fair offer and you need to take action against them, this is called a first party claim.

With first party claims, you are dealing with your own insurance company. Even though you’ve paid your premiums every month, the insurance company refuses to give a fair offer for your business interruption loss claim. We’ve heard of insurance companies delaying in communications or even ignoring policyholders altogether, especially after a claim has been denied.

So, what do you do when you feel your loss of business claim wasn’t fairly evaluated?

Gather all the information you can – correspondence to/from the insurance company, a record for your demonstrable losses, and a copy of your policy are all good places to start.

- Act quickly. There may be certain deadlines in place that dictate how much time you have to file your claim against the insurance company.

- Contact our team however is convenient. Our firm has adopted COVID-19 safety measures and can meet with you virtually, by telephone, email, or chat session to start outlining your case. We’ll go over all the information you provide and can help you understand the path forward.

- Let an experienced business interruption attorney represent you. Our team takes on the burden of contacting your insurance company and negotiating on your behalf towards a fair settlement. If the insurance company won’t deal fairly, we’re wholly prepared to take them to court. We’ll cover all of the upfront costs and, in fact, you pay us nothing unless we are successful.

If your loss of business insurance claim was denied, then you owe it to yourself to hire business interruption attorneys who understand what you’re going through. Get a free case review now!

Benefits of Hiring a Lawyer to Represent Your Business Interruption Claim

It’s a sad fact that insurance companies frequently deny the claims of hardworking business owners. Even when they do approve a claim, they can ruin it with long payment delays.

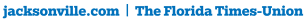

You worked hard to build your business. It’s not right that insurance companies get to play you for their fool. If your business interruption claim has been delayed or denied, then you owe it to yourself to contact Farah & Farah as soon as possible. We have a winning track record of helping business owners throughout Georgia and Florida.

The business interruption attorneys at Farah & Farah will stand by your side in your fight against the insurance company. Our business interruption case lawyers can help you:

- Define what your policy outlines as your eligible benefits and covered losses.

- Thoroughly investigating your claim to rule out bad faith actions.

- Launching a comprehensive damage assessment that includes legal professionals, business experts, and engineers.

- Fighting for your reimbursement and handling communications between you and your insurance.

- Navigating the complicated world of interruption of business claims with a transparent and action-oriented approach.

- Fight your business interruption case in a court of law, if necessary.

Business Interruption Attorneys Serving Florida and Georgia

It makes our blood boil as insurance giants rake in billions in profits and then fail to present a fair offer on a loss of business insurance claim for a small business owner. Policyholders are made to believe they have the tools in place to protect their business, only to find they’ll have to fight tooth and nail whenever they need to file a loss of business claim. Simply put, we don’t think that’s fair. We love this community, the people here are friends, family, and neighbors. With so many people in our area hurting, we knew we had to do something to help.

Contact a business interruption claim attorney now to review the details of your business interruption insurance claim. From there, we’ll help navigate the legal waters towards seeking maximum compensation for your loss of business claim. Get started today with a no-obligation case review now!

free case review

Related Pages

Client Testimonials

Related Blogs