Bad Faith Insurance Attorneys

The events that lead you to file a claim with your insurance company are stressful and difficult. The insurance company you trusted and paid to have your back in hard times should not add to your heartache. Unfortunately, some insurance companies do not act in their client’s best interests. There should be consequences when these companies look the other way.

Home » Insurance Dispute Lawyers » Bad Faith Insurance Attorneys

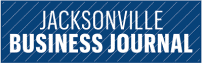

If you believe your insurance company is acting in bad faith, then you need an attorney to work for your best interests. Trust the bad faith insurance claim lawyers at Farah & Farah to fight for the justice you deserve. We are available 24/7 over the phone at 877-245-6707 or schedule your free, no-obligation case review now.

What is “Bad Faith” Insurance?

The insurance industry is founded upon a very basic contract: the customer provides monthly payments or yearly premiums, the amount of which depends upon the customer’s risk factors to the insurance company, in exchange for significant financial assistance.

When something goes wrong, such as a car accident, medical malpractice, or a slip and fall injury. The insurance company initially profits since it receives guaranteed payments from the customer to provide protection against a hypothetical event in the future that may not happen. This is the fair tradeoff between the two parties, and federal law requires insurance companies to act in good faith toward their insured customers.

However, some insurance companies do not always honor this contract. They either refuse to hand over a full and fair settlement or deny payment altogether, although the claimant is entitled to it. This is considered acting in “bad faith.” Such wrongful conduct is in relatively popular practice because many people are unaware of their rights and do not fight claim denials all while the insurance industry profits.

Examples of Bad Faith Tactics

An insurance company may be acting in bad faith if they are:

- Failing to conduct a prompt and thorough investigation of a claim

- Misinterpreting or inaccurately representing the law or the policy

- Refusing to provide an adequate settlement

- Terminating a legitimate claim

- Delaying payments

- Making threatening statements

- Refusing routine requests for documentation

Proving Bad Faith in a Bad Faith Insurance Claim

In order to establish a valid bad faith lawsuit, you must be able to prove that a benefit of your insurance policy was denied and that this decision lacked proper cause. Hiring a lawyer that knows what to do with bad faith insurance claims can go a long way to helping you get the justice you deserve.

The knowledgeable bad faith insurance lawyers at Farah & Farah are prepared to help you document your claim and walk you through every step of the process. We will work to get you the settlement you deserve, and because we work on a contingency basis, you won’t pay a dime unless we win your case.

What Damages Can Be Collected In A Bad Faith Lawsuit?

In addition to the insurance policy’s benefits that you are owed, you may recover consequential damages, such as lost wages, attorney fees, and even damages for emotional distress. If it can be proven that your insurer committed flagrant, intentional, and/or gross misconduct, you may recover additional punitive damages, as well.

Laws governing potential damages in bad faith lawsuits vary by jurisdiction, and our expert team of bad faith insurance claim lawyers are ready to put its more than 40 years of experience to work for you.

Contact Our Bad Faith Insurance Lawyers Today

If you suspect that your insurance company is acting in bad faith, get in touch with the knowledgeable bad faith insurance claim attorneys at Farah & Farah today.

Our team has the experience and the tools to fight back against the insurance industry and get you the results you deserve. We will help you fight back against their underhanded tactics for you. For a free, no-obligation consultation, please call our office at 877-245-6707 or schedule your case review online.

free case review

Related Pages

Client Testimonials

Related Blogs