Water Damage Attorneys

From pipe bursts to roof leaks to floods, there are a lot of ways water can damage a home. Water can cause damage to a home, even if it’s cleaned up immediately. But it can cause even more damage over time, including warping and mold. Standard homeowners’ insurance policies typically cover water damage, but they do exclude some perils. Hurricanes and floods from the weather are typically not covered perils.

Home » Insurance Dispute Lawyers » Property Damage Attorneys » Water Damage Attorneys

After experiencing water damage, the last thing you want to do is fight with your insurance company. Farah & Farah’s water damage attorneys have helped people across Florida and Georgia put their lives back together. Call us 24/7 or schedule your free case review online now.

Causes of Water Damage

While causes like floods and burst pipes may seem like they are similar, your insurance company usually sees these differently. While your insurance policy may cover internal malfunctions like suddenly burst pipes, storms or unpredictable weather patterns are not usually covered.

Learn more about the difference between isolated/internal water damage and storm-related water damage below:

Isolated/Internal Water Damage

Water damage can be caused by a number of perils. Any time water enters a home where it shouldn’t, water damage can occur. Sometimes, the water can come from an internal source, such as an appliance or pipes.

Sources of isolated water damage may include:

- Worn out or malfunctioning household appliances

- Blocked gutters

- Issues with the plumbing

- HVAC Issues

- Defective windows

- Not properly sealed roofs

- Issues with toilet

- Damaged foundations

Storm-Related Water Damage

Storms or floods can happen at the drop of a hat. When severe weather unleashes its full fury on your property, you are at risk of flash flooding or roof damage. These conditions can be especially harrowing for people in flood-prone areas.

Common causes of storm-related water damage include:

- Flash flood or flood

- Tornado or hurricane damage

- Powerful wind storms or thunderstorms

What Type of Water Damage is Covered by Homeowners Insurance?

Every insurance policy differs regarding coverage, deductibles, and other stipulations. Factors like the source of the damage, your policy, how sudden the damage was, or if it occurred suddenly can affect your coverage.

Standard homeowners’ insurance policies typically cover some water damage, but not all. The difference comes in with the peril that caused the water damage. Most standard homeowners’ insurance policies will cover water damage caused by an internal source, such as from the plumbing or a pipe burst, or a roof leak. Even then, if the leak was gradual, they may still deny you.

Policy add-ons like flood insurance can cover external damages. You usually have to pay extra for these benefits.

Water Exclusion Clause

A water exclusion clause is a clause in an insurance policy that excludes certain perils that can cause water damage from being covered by the policy. These clauses typically exclude water damage from things like earthquakes, floods, hurricanes, etc. However, some weather-related causes are still included. The water exclusion clause typically excludes perils that are considered more of a risk, such as hurricanes in Florida.

Hurricane

Because Florida is prone to hurricanes, water damage from these storms is typically not included in standard homeowners’ insurance policies. There may be an additional deductible that is required to be met before the insurance company will pay for anything. There may also be a separate hurricane insurance policy.

Flood

Flooding is also typically excluded from standard homeowners’ insurance policies. This is especially true if the flooding is caused by weather, such as rain or a hurricane. If flooding is caused by a pipe burst, however, that water damage is often not excluded from the policy.

Filing an Insurance Claim for Water Damage

If your home has been damaged by water, you should first submit a claim to your insurance company before considering any kind of legal action. You’ll also want to make sure you take all the proper steps to make a claim the right way so that the insurance company doesn’t have an excuse to deny your claim.

Assess the Damage

The first step is to thoroughly assess the damage. The true extent of the damage may be difficult to determine on your own, so you may want to call in a professional to inspect it. This has the added benefit of being able to prove the actual cost of the damage to your insurance company.

When you make a claim, the insurance company will send out an adjuster to inspect the damage. However, the adjuster may be biased in favor of the insurance company. Having an independent professional examine the damage can help bolster your case with your insurance company.

You should also thoroughly document all damage. Keep any reports from the professional who inspected the damage. Take photographs of everything.

Review Your Insurance Policy

It’s also important to know exactly what your insurance company covers and what it excludes. Before you go through the process of filing a claim, you’ll want to know if the peril that caused the water damage is covered or not. You’ll also want to know if there’s a deductible on your policy or any other requirements or limitations to your policy.

Notify Your Insurance Company

You should notify your insurance company as soon as possible of the damage. Water damage can get a lot worse over time, so the longer you wait, the greater the chance that the damage will become a lot more extensive. The longer moisture is in your house, the more likely mold will grow. In addition, while the insurance company should cover the damage from any covered peril, they may not cover damage sustained because the repair and cleanup were left too late.

Keep Maintenance Records

You should keep maintenance records for everything done on your home. This is so that you can prove to your insurance company that the damage wasn’t caused by a lack of maintenance. During the repair process, these records will also prove if you’ve met your deductible if one exists, and show how much you’ve paid if the insurance company is reimbursing you for the costs.

What if Your Water Damage Claim is Denied?

Millions of homeowners across the country pay into insurance policies so that when something happens to their home, their insurance company will be able to cover it for them. Isn’t that what the insurance policy is for? But insurance companies are still businesses that want to make a profit. Insurance companies can’t make money if they’re paying out a lot of money in claims.

Insurance companies are businesses. Despite the money you have been paying them for your policy, your insurance may not want to cover any damages. Some insurance companies may deny claims in bad faith in order to increase their profits.

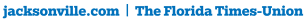

If your home has sustained water damage and your insurance company has denied your claim, you may have a case. Contact Farah & Farah for a free consultation today. You won’t have to pay a dime unless your case is successful.

Water Damage Attorneys in Florida & Georgia are Ready to Serve Your Case

If your home has suffered water damage from a peril that is covered by your insurance policy, but the company denied your claim anyway, you may have a case. A lawyer can not only help you understand the details of your insurance policy and any laws that may be relevant to what your insurance company is required to cover, but also determine whether your claim was denied in bad faith.

Farah & Farah’s team of skilled lawyers is here to help fight against unscrupulous insurance companies that deny claims in bad faith in order to put profit over people. We’re experienced at taking on insurance companies and want to help you get the compensation you deserve. Contact us online or call us 24/7 to schedule a free consultation. You won’t have to pay anything unless your case is successful.

free case review

Related Pages

Client Testimonials

Related Blogs