Personal injury protection (PIP) insurance, also known as no-fault insurance, provides coverage for you and those insured on your policy for medical expenses and other damages resulting from a motor vehicle accident regardless of who is at fault. Some states like Florida require PIP insured.

In an ideal world, your injury would receive swift and considerate action from the insurance company. However, the majority of car accident claims face issues. The sad truth is that insurance companies are businesses that want to protect their bottom line. Many of them benefit from giving you the runaround or dragging their feet on your claim.

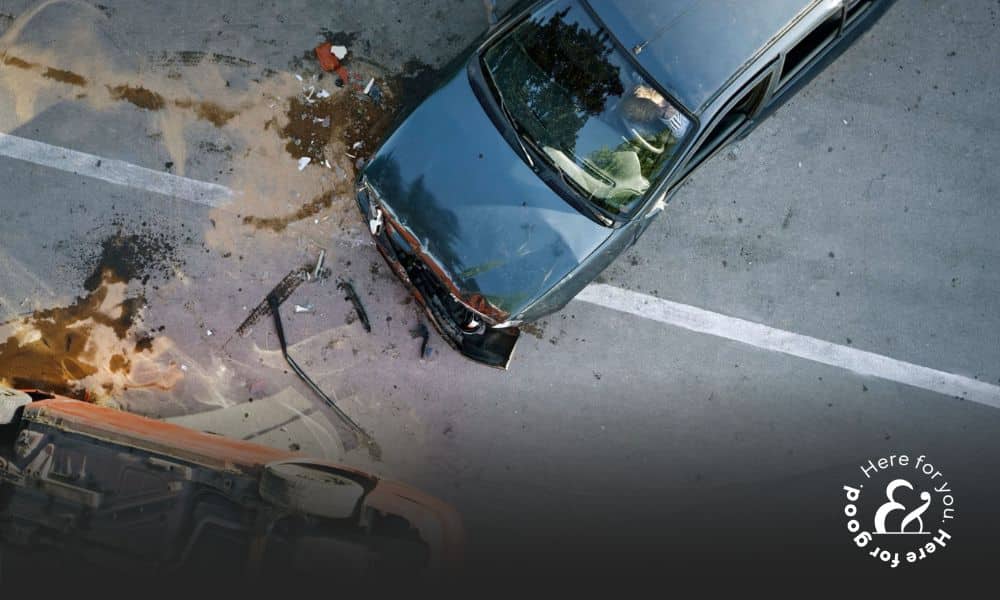

No one should have to jump through hoops after being in a car crash.

If you or a loved one have been involved in a car accident, you may be wondering what to do next. Hiring an attorney who understands personal injury protection (PIP) can help you recover what you’re owed.

Is PIP Insurance Required in Florida?

Yes. Florida is a no-fault car accident state. As a no-fault state, Florida law guarantees that any person involved in a car accident can receive personal injury protection and requires that every car registered in the state carry a minimum of $10,000 in coverage. As a policyholder, you can choose whether you want your insurance to cover you or your whole household.

What Does PIP Insurance Cover?

PIP insurance provides up to $10,000 in funds for policyholders in Florida. While these funds can help cover the cost of prescriptions, surgical treatments, and ambulance fees, they can also refund your lost wages, home care, pet care, or funeral costs. This sum can account for up to 80% of medical costs and 60% of your lost wages. This means if your medical bills total $8,000, your PIP coverage will provide $6,000 toward your recovery.

Even if your total damages are under $10,000, you can still go after the at-fault driver for any bills or expenses not covered by your PIP. This means you may be able to sue the negligent party for additional compensation.

How to File a PIP Claim

You need to get started on your claim as soon as possible. Follow these steps to file a PIP claim after getting in touch with our personal injury lawyers in Orlando and throughout Florida:

- Report the collision by contacting your insurance company.

- While on the phone with your insurance company, make sure your plan includes PIP coverage.

- Ask the insurance representative to provide you with your claim number and the claim office’s contact information.

- Contact the claims office and talk to the insurance adjuster for your case.

- Request that the adjustor provides you with a PIP application as soon as possible. Additionally, ask for a salary verification form and a physician’s report.

- Fill out your PIP application as soon as possible.

- Request that your physician fills out the Attending Physicians Report.

- Then request that your employer fill out the Salary Verification Form. You’ll only need to do this step if you missed work as a result of your injury.

- Return both the Attending Physicians Report and Salary Verification Form to your adjustor.

- Provide your health care providers with your claim number, adjuster name, and claim office contact information.

- Authorize your healthcare providers to bill your PIP directly.

Getting the insurance company to do the right thing requires quick action as there is a limited window for qualifying for PIP coverage. Failure to act may cause you to forfeit your right to seek compensation. All victims of car accidents in Florida can petition for their PIP benefits.

Do I Have a Time Limit to File a PIP claim?

You have 14 days to seek medical treatment following an accident under PIP rules. It is always a good idea to seek medical treatment immediately following a crash. Let a doctor determine the extent of your injuries.

If you were injured in an accident due to someone else’s negligence, Farah & Farah is here for you. We’ve relentlessly fought for the right to compensation for our clients and their families since 1979.

What Medical Costs are Covered Through PIP?

Most medical treatments associated with car crash injuries are covered through PIP. This includes:

- Medical services

- Pharmaceuticals

- Surgical services

- Rehabilitation costs

- Diagnostic test costs

- EMS care

There are certain treatment options not covered by PIP, including massage therapy and acupuncture.

When it comes to the costs, PIP has limits. PIP does not cover all of medical expenses. Florida’s PIP law says that IP will only cover 80% of each medical bill. The remaining 20% is your copay. You may also have a deductible. However, if you have health insurance, it can also be used to offset, and sometimes eliminate, your medical bills.

The amount of coverage available is required, by law, to be at least $10,000. However, you should ask your doctor if your injury is considered an emergency. PIP will only cover up to $2,500 worth of benefits if a doctor does not recognize an Emergency Medical Condition.

What About My Lost Wages?

In addition to medical wage, PIP in Florida will pay for 60% of your lost wages up to the total $10,000 limit. This coverage may also extend to things you would normally be able to do but can no longer do because of your injuries, including some home care expenses, such as:

- Cleaning your house

- Taking care of pets

- Doing laundry

- Caring for children

- And more

It’s important to note that PIPbenefits apply to both medical and lost wage expenses. If you have $10,000 in benefits, this is a total amount, as opposed to $10,000 for medical and $10,000 for wages.

Are There PIP Death Benefits?

If the PIP policyholder is killed in an accident, PIP will pay for funeral and burial expenses in addition to the benefits already discussed. There is a limit of $5,000 for these costs.

What if This Isn’t My First Accident?

PIP coverage resets each time you are in an automobile accident. If you find yourself in another crash, even just shortly after the first one, all of the PIP benefits listed above will reset medical costs and lost wages benefits.

Does PIP Prevent a Person from Pursuing a Personal Injury Lawsuit?

If your total medical bills or lost wages were over $10,000, or if you suffered from a permanent injury, you can still file a personal injury claim against a negligent driver. Essentially, Florida is a no-fault state until the costs of an accident exceed PIP coverage limits. You should always speak with a qualified and experienced attorney in Florida about your specific case.