Hurricane Prep: Before, During, and After the Storm

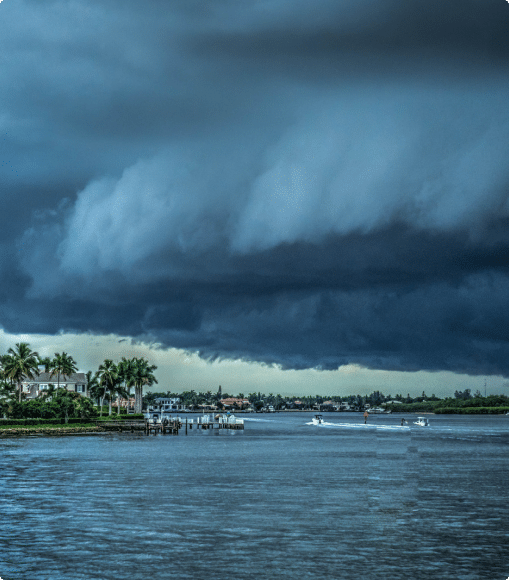

The Atlantic hurricane season lasts from June 1 through November 30, posing a very real risk of destruction and devastation. The threat is particularly strong in Florida, which has seen 125 recorded hurricanes since 1851. Unlike tornados and other quick-forming storms, you typically have advance warning that a hurricane is approaching. This gives you time and the opportunity to prepare properly for the storm, protect your property, and get your family to a safe location.

Knowing what to do before, during, and after a hurricane can make all the difference. Here’s what you need to know to limit the potential damage of a hurricane.

Before the Storm

The best time to prepare is before hurricane season begins. Between November and June, take time to get familiar with and review your insurance coverage (on an annual basis at least as policies can change). Find out what your homeowner’s insurance policy will and won’t cover if a storm damages your home. If your policy doesn’t cover flood damage and you live in a flood-risk area, consider adding flood insurance to your plan. And keep in mind that flood maps are evaluated and subject to change every five years.

You’ll also want to determine your evacuation zone and locate evacuation routes if you live on or near the coast. Map out your route and identify shelters you can easily reach when a storm hits.

In the days leading up to a storm, hurricane warnings are typically issued about 36 hours before tropical storm-force winds are anticipated to begin. This leaves at least a day and a half (on average) to prepare for the imminent impact of the storm.

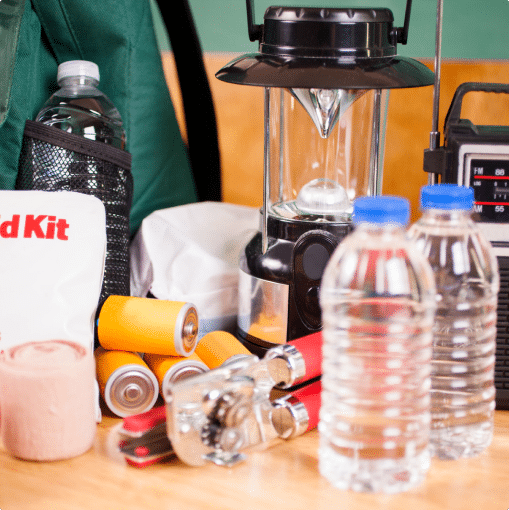

Gathering Emergency Supplies

It’s a good idea to gather and store emergency supplies year-round. This can alleviate the stress of fighting crowds at local stores when a hurricane warning is issued. Of course, some supplies are perishable, so you’ll need to stock up on those in the days and hours before the storm’s arrival.

Important emergency supplies to have on-hand include the following:

- Flashlights

- Batteries

- Battery-powered or crank radio

- Bottled water – approximately one gallon per person, per day

- Whistle

- First aid kit

- Plastic sheeting or tarps

- Duct tape

- Toilet paper

- Basic hand tools, including a hammer, screwdriver, and wrench

- Manual can opener

- Medications

- Backup generator with fuel to run it, if possible

- Extra gasoline

- Sandbags

- Fire extinguisher

- Maps of your local area

- Copies of your driver’s license and other identification

- Bug spray; this can come in handy as there is often standing water after a hurricane

- Rubber boots

You’ll also want to store enough food to feed your family for several days. Consider that you’ll likely be without electricity, so it’s smart to stock up on things like granola and protein bars, peanut butter, bread, dry cereal, canned fruits and vegetables, or canned or pouched juices. Look for healthy food that can provide high-quality energy to sustain you and your family for long periods.

If you have an infant, make sure you have shelf-stable baby food for them. Special considerations should also be made for elderly or differently abled household members.

Prepare Evacuation Route and Ensure Your Car Is Ready

Florida has six major evacuation zones, A through F. A is most susceptible to hurricanes and most likely to be evacuated. F is the least susceptible and typically the last to be evacuated.

Know your hurricane zone and get familiar with planned evacuation routes. Don’t wait until a hurricane strikes to learn this important information.

Keep an eye on the local news and have a storm radio handy to let you know if your zone will be evacuated.

Once you know your evacuation route, check that your car is gassed up and ready to hit the road. Keep up with regular oil changes, maintenance, and inspections during the off-season to ensure you have a safe and reliable vehicle to get you to safety.

Move any extra vehicles into your garage if you have one to help protect them from storm damage.

Prepare Your Home

Whether you shelter in place or evacuate, preparing your home for the storm is important. Key steps include the following:

- Clear your yard of items that hurricane winds can pick up and throw, including bicycles, outdoor furniture, umbrellas, toys, grills, tree fruits, potted plants, and propane tanks.

- If you have a pool, turn off any power to equipment, add extra chlorine, and remove toys and floats. Do not cover your pool.

- Protect your windows by using storm shutters or nailing pieces of plywood over the glass to protect them from high-speed winds. Be careful to do this the right way! Here’s a video for more info.

- Know how to shut off power to your home in case of flooding and downed electrical wires, especially if located in a difficult-to-reach place during the storm.

- Make sure that the batteries in your carbon monoxide and fire monitors are working properly.

- Check your roof and replace any missing shingles or braces to minimize water damage—this should be done outside of hurricane season (Nov.-June).

- Move important documents, batteries, electronics, and similar items to water-tight storage containers or high up in your home to protect them from flooding and water damage.

The more you do beforehand, the less damage you’ll potentially have to deal with when the hurricane has passed.

Review Your Insurance Policy

Find your homeowner’s insurance (or, renter’s insurance if applicable) documents and review your policy’s terms, including the following:

- Review what’s covered if your home or property is damaged by a storm.

- Review what’s not covered.

- Know your deductibles. Most homeowner’s insurance policies have hurricane-specific deductibles higher than standard deductibles. Often, hurricane deductibles are expressed as a percentage—typically one to five percent—of the home’s insured value. The higher your deductible, the more you’ll be expected to pay out of pocket before your insurance coverage kicks in. Your insurance company will choose a trigger for when to implement your hurricane deductible, which might be when the National Weather Service names a storm or when a hurricane warning is formally issued.

- What are your policy limits? What’s the maximum your insurance company will pay to cover your losses? You’ll want to check your home’s appreciation and ensure the limits are enough to rebuild your home.

- Double-check that your policy covers flooding and flood damage.

- If you’re a renter, check the details of your renter’s insurance policy. You likely need to select additional coverage in your renter’s insurance policy to include hurricane damage. And flood damage is never covered under renter’s insurance policies, although it is possible to get flood insurance as a renter. It can be helpful to check whether a home is in a flood zone prior to renting it. Limits are typically rather low since renters don’t have the overhead of the actual building or structure, but you can adjust it according to the approximate cost of your personal items.

- Homeowner’s and renter’s insurance do not cover flooding. Thus, you’ll need to purchase a separate policy for coverage. Flood insurance is available through your insurer or the National Flood Insurance Program. Act early because flood insurance requires a 30-day waiting period.

- Review your car insurance policy to ensure your car is covered in case of a flood.

Keep your insurance documents and contact information in a secure, dry place so that you can get help when you need it.

Preparation Tips for Those with Chronic Illnesses or Disabilities

If you or a loved one is elderly or suffers from a chronic illness or disability, it’s important to take extra steps to prepare for a hurricane.

- Gather necessary medical supplies and keep them accessible, including extra prescription medications, medical devices and equipment, oxygen, and other critical items.

- Gather medical records and documents that might be needed if you or a loved one require emergency medical treatment.

- Consult with your doctor about how to receive treatment like chemotherapy or dialysis if a hurricane strikes.

- Coordinate transportation with county services or ensure your vehicle is equipped to transport anyone with special physical requirements.

- Pre-register for a spot at a special needs shelter in case you need to evacuate. You can get information about special needs shelters near you by contacting the health department or local emergency management office.

Consider the specific needs of your family member. Make sure that you have everything they’ll need to maintain their health if you have to shelter in place or evacuate.

During the Storm

If you’re sheltering in place, find a central place in your home, preferably on the first floor, that’s away from any windows, skylights, or doors. Bathrooms, closets, and pantries located in the middle of the home tend to be good options. If you have a basement and are less worried about flooding, find a spot away from windows and find something heavy to hide under.

If the storm is predicted to get violent, cover yourself with a mattress, sleeping bag, or heavy blanket to protect against debris that might fly around the room when the winds hit.

Stay inside, no matter what. Keep your radio on at all times—or TV if electricity stays on—during the storm to stay informed about the storm’s location, strength, and progress.

After the Storm

Once the hurricane has passed, it’s important to remain cautious. Stay in a safe place until you are able to venture outside. Even then, be aware of potential hazards.

- Flooding is common during hurricanes, so check your location to see if your roads and streets are accessible. Look for downed power lines or utilities that could pose a serious risk of electrocution or death. Be aware that floods can draw wildlife, including alligators and other dangerous animals, from local waterways. Floods may also contaminate your home’s water supply.

- Avoid lighting candles. Natural gas can be released if pipes or stoves are damaged, posing an explosion risk. Use a flashlight instead.

- Avoid hazards at all costs. Remain in your home and call 911 for emergency assistance or rescue if necessary.

- Continue using your emergency supplies, especially bottled water, once the storm has passed. Storms and flooding often contaminate tap water, which could threaten your health if consumed or used for bathing.

- Contact local friends and family members to check on them.

Once it’s okay to emerge from your safe spot or return home, you can assess the damage to your home, belongings, and property.

Assess Damage and Clean Up

Walk your property and make a note of anything that has been damaged or destroyed by the hurricane. Take pictures and videos as evidence for your homeowner’s insurance claim. Maintain all evidence in a hurricane damage log.

You should pay particular attention to:

- The condition of your roof

- Water damage and flooding

- Missing siding

- Damaged appliances

- Rugs and carpets

- Drywall and sheetrock

- Damaged outdoor structures, including sheds

- Changes in the foundation or structure of your home

- Damage to vehicles

- Windows and doors

When you’re documenting the damage, try to mark the value or cost of each item, as well as what you paid. Supplementing your evidence with receipts, bills, and invoices can help you get the full amount of your coverage.

Once you’ve assessed the damage, it’s time to begin clean-up. Remove shutters and plywood from windows and doors if you applied them. Opening them will allow excess moisture to leave your home and minimize the damage it may cause.

If your home has flooded, put on heavy rubber boots to protect your feet and legs as you walk through your home. Remove any items that have been destroyed or badly damaged in the storm.

Once you’ve removed any hazards and debris, begin to disinfect and sanitize your home. Many experts suggest spraying a mixture of bleach and distilled water—one cup of bleach to one gallon of water is the recommended recipe. Storm water can bring sewage, oil, and other hazardous elements into your home. Protect your family by giving your home a deep clean.

Homeowner’s Insurance and Hurricanes

Contact your homeowner’s insurance company immediately after you’ve assessed the damage to your property. You’ll only have a limited time to file a claim after the storm.

Keep in mind that the company may be overrun with requests for assistance, so be patient and persistent.

If the hurricane was particularly severe, funds may be available immediately. These funds, known as additional living expenses, or ALE, are intended to help you seek shelter and cover necessary costs like food and travel if your home is uninhabitable.

The company representative can help you initiate a claim and understand what documents and information you need to proceed. Ask the representative if you should begin to get estimates for repairing or rebuilding your home.

Once the claim has been initiated, the insurance company will assign an adjuster. This person may visit your home in person to go over the damage. The adjuster will review the evidence you’ve gathered and assess the damage themselves.

The adjuster will determine what will be covered by your policy and how much should be paid. If you’re not satisfied with the insurance company’s adjuster, you have the option of hiring a public adjuster to assess the hurricane damage.

If there is a legitimate insurance dispute over hurricane damage, coverage, payment, or the terms of your policy, it’s smart to consider speaking with an experienced hurricane attorney about your situation. Your attorney can review your property insurance claim, determine whether the insurance company has handled your claim in bad faith, and help you engage in more meaningful conversations about getting the benefits you need and deserve. If necessary, your attorney can help you file a hurricane insurance lawsuit and bring the insurance company to court.