Table of Contents

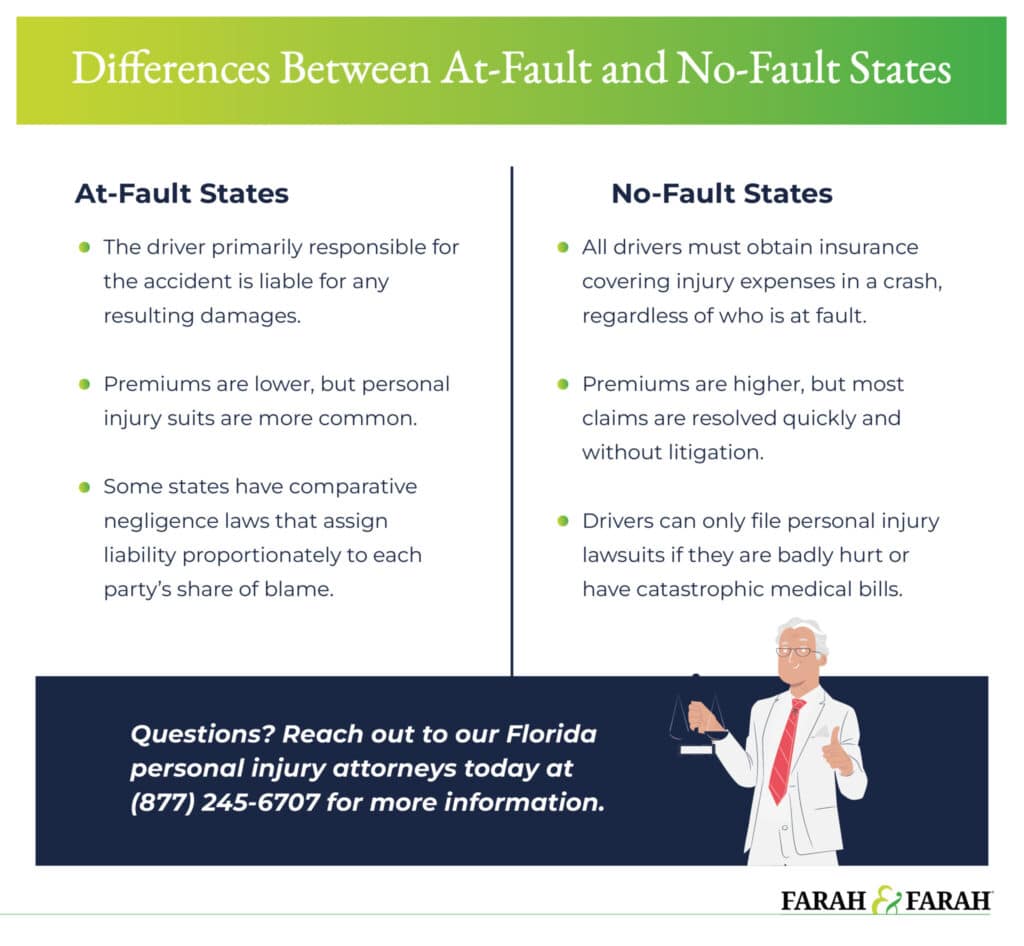

Florida is a no-fault state, which presents both advantages and disadvantages compared to living in an at-fault state. In a no-fault state, you must first turn to your own insurance policy for coverage of your losses, regardless of who is at fault.

This system allows you to recover compensation without enduring expensive and lengthy litigation. However, a no-fault insurance policy only covers certain economic losses and may not cover all your damages, and no-fault laws limit who can file a claim against an at-fault driver.

What Does It Mean That Florida is a No-Fault State?

In a no-fault state such as Florida, every driver must carry no-fault car accident insurance known as personal injury protection, or PIP. When you are involved in an accident, you must first file a claim under your Florida PIP insurance coverage. There is no need to prove the other driver was at fault when filing a no-fault insurance claim.

In Florida, PIP covers 80 percent of your medical expenses and 60 percent of your lost wages up to $10,000. The PIP policy must also provide a $5,000 death benefit along with covering medical expenses and lost wages incurred before death. PIP does not cover non-economic damages like pain and suffering. Your PIP insurance covers the following people in an accident:

- You

- Relatives living in your household

- Passengers in your vehicle

- Pedestrians and bicyclists struck by your vehicle

What Are Florida’s Insurance Requirements?

Florida drivers must carry a minimum of $10,000 in PIP and $10,000 in property damage liability insurance. Most Florida drivers are not required to carry bodily injury liability insurance. However, there are the following exceptions:

- Vehicles registered as taxis must carry bodily injury liability insurance of at least $125,000 per person and $250,000 per accident. They also must carry at least $50,000 in property damage liability coverage.

- Anyone convicted of a DUI during the last three years must carry bodily injury liability insurance of at least $100,000 per person and $300,000 per accident. They must also carry a $50,000 property damage liability policy.

Requirements for Teenage Drivers

The insurance requirements are the same for young drivers as for adults. You can add your child to your coverage or purchase a separate policy. Most insurers require you to add every household occupant to your policy if they are old enough to drive, including teenagers, regardless of whether they hold a driver’s license. However, if you are the foster parent or caregiver of a minor placed outside the home, no insurance company can charge an additional premium while the minor has a learner’s permit.

Are There Any Exceptions to Florida’s No-Fault Laws?

Even though Florida is a no-fault state, you can file a claim against the other driver and other liable parties if you meet certain criteria.

When Your Injuries Are Serious

If you sustain permanent and severe injuries from the accident, you may be able to pursue recovery from the at-fault driver and file a claim under their bodily injury liability insurance if they have such coverage. If the driver doesn’t have this coverage, you can go after the driver’s personal assets or look for additional liable parties that carry insurance.

Serious injuries that allow you to sue another party for a car accident in Florida include the following:

- Permanent disabilities

- Loss of an important bodily function

- Significant scarring or disfigurement

- Death

You must still file a claim under your own PIP coverage first. However, pursuing a claim against the driver and other liable parties can allow you to recover compensation for additional medical expenses and lost wages not covered by PIP or that exceed the $10,000 limit.

If you meet the threshold, you can also sue to recover non-economic damages such as pain and suffering, which you cannot recover under your PIP coverage.

When You Need Coverage for Property Damage

PIP also doesn’t cover property damage. Instead, you can pursue a claim under your collision coverage and pay the deductible or file a claim under the at-fault party’s property damage liability insurance to recover damages for this type of loss. There is no requirement to file a PIP insurance claim before filing a property damage claim against the driver.

If You Are a Motorcycle Rider

Florida’s no-fault insurance laws only apply to four-wheeled vehicles, meaning the no-fault system does not cover motorcycles. If you are injured while riding a motorcycle, PIP coverage will not apply unless you have purchased optional coverage. Instead, you must pursue compensation from the at-fault driver and any liability insurance the driver owns. You also can seek damages from any other party that caused or contributed to your injuries.

If you were injured in an accident due to someone else’s negligence, Farah & Farah is here for you. We’ve relentlessly fought for the right to compensation for our clients and their families since 1979.

What if I Am at Fault for the Accident?

Being at fault for a car accident in Florida doesn’t affect your no-fault insurance coverage unless you cause an accident intentionally or while committing a felony. Below are just a few examples of the types of accidents that may be covered by PIP, even if you were at fault:

- Rear-endings

- Sideswipes

- Left-turn accidents

- Failure-to-yield accidents

- Disobedience of traffic signals

- Wrong-way accidents

- Lane change accidents

Can I Recover Damages From the Other Party if I’m at Fault?

If you are severely injured in an accident for which you are at fault, you may still be able to recover compensation from the other party, depending on your share of the fault. Florida’s modified comparative negligence law allows you to recover compensation if you are less than 51 percent responsible for the accident. However, your compensation will be reduced in proportion to your share of the blame.

If the insurance company or law enforcement has determined that you are at fault for the accident, don’t accept this decision as final. Instead, call us at (866) 246-0141. Insurance companies are financially motivated to assign you as much fault as possible.

We will conduct a more in-depth investigation of the accident than law enforcement. We interview eyewitnesses, download black box data from all vehicles involved, and work with renowned forensic experts—all as part of our commitment to proving you are less than 51 percent responsible and minimizing your share of fault to the fullest extent possible.

What if the Other Driver Is Uninsured

If you are seriously injured by an uninsured driver, you can turn to your uninsured motorist coverage after filing your PIP insurance claim.

What Is an Uninsured Motorist in Florida?

Florida law defines an uninsured motorist as any of the following:

- A driver that doesn’t carry any of the required insurance

- A driver that carries the required PIP and property damage liability insurance but not bodily injury liability insurance, which the law does not require

- A driver whose insurance doesn’t cover all of your damages

What Does Uninsured Motorist Insurance Cover?

Uninsured motorist insurance pays damages the at-fault party’s insurance would normally pay. It isn’t an extension of your PIP insurance but a substitute for the at-fault driver’s liability insurance when the other party is uninsured or underinsured. Uninsured motorist insurance covers property damage, medical expenses, lost wages, pain and suffering, and other economic and non-economic damages up to your coverage limits.

When you file an insurance claim, you initiate an adversarial relationship with the insurance company. It will resort to various tactics to minimize your compensation. Although you pay monthly premiums for your uninsured motorist coverage, filing an uninsured motorist claim and the adversarial tactics of insurance companies is typically no different than pursuing a claim with an at-fault party’s insurer.

Our dedicated Florida car accident lawyers have been standing up to insurance companies on injured accident victims’ behalf for more than 45 years, and our experience makes all the difference. We know what it takes to hold an insurance company accountable and are dedicated to pursuing full compensation. Wherever you are in the state, we are ready to go to work for you. Contact us today from Tampa, Fort Myers, Orlando, Jacksonville, or anywhere else in Florida to schedule a free consultation.

Our Florida Car Accident Attorneys Are There for You When You Need Us Most

If you or your loved one has been injured in a car accident anywhere in Florida, you can trust our skilled and compassionate attorneys to get you through it. We have recovered over $2 billion in verdicts and settlements, and our outcomes are no accident. We get results through caring, understanding, and hard work. We have been protecting you and your family since 1979, and our success is rooted in our client-centric approach. When you have our caring and experienced Florida personal injury lawyers on your side, you can expect the following from us:

- A dedicated team of skilled lawyers who will work together to get you the best possible outcome

- An open-door policy that ensures you will always be able to reach your legal team

- A thorough accident investigation so we can identify every party who owes you compensation

- A detailed analysis of all of the parties responsible for your injuries, their financial resource, and insurance policies

- A search for insurance policies you own, such as an umbrella policy, that can cover any damages not covered by other available insurance

- Skilled and tenacious advocacy during your insurance claim through settlement negotiations and, if necessary, a trial

Our passionate team of attorneys knows where to look for coverage and how to talk to insurance companies so they pay the compensation you deserve. We will handle your insurance claim and file a lawsuit if the insurance company refuses to pay fair compensation.

Schedule Your Free Consultation Today

Florida’s no-fault insurance laws can complicate a car accident settlement. But when you have our talented injury lawyers on your side, you can focus on recovery while we do the hard work. You risk nothing by working with us. The initial consultation is free, and we charge no fees for our services unless we win. We treat every client with honesty, dignity, and respect.

Call us today at (866) 246-0141 to schedule your free case evaluation and let Team Farah go to work for you.