Being involved in a car accident is a stressful and often traumatic experience. The aftermath can leave you dealing with not only physical injuries but also the daunting task of handling medical bills. This comprehensive guide outlines the steps you should take following an accident, how medical treatment is processed, and answers the vital question: Who pays for medical bills after a car accident?

Medical and Insurance Timeline After a Car Accident

If you find yourself involved in a car accident, here’s a step-by-step guide to navigate through the process of managing and paying for any medical expenses resulting from injuries sustained in the accident:

- Seek medical attention for injuries sustained in a car accident

- Be prepared to cover upfront costs such as deductibles or copayments

- File a claim with your car insurance provider

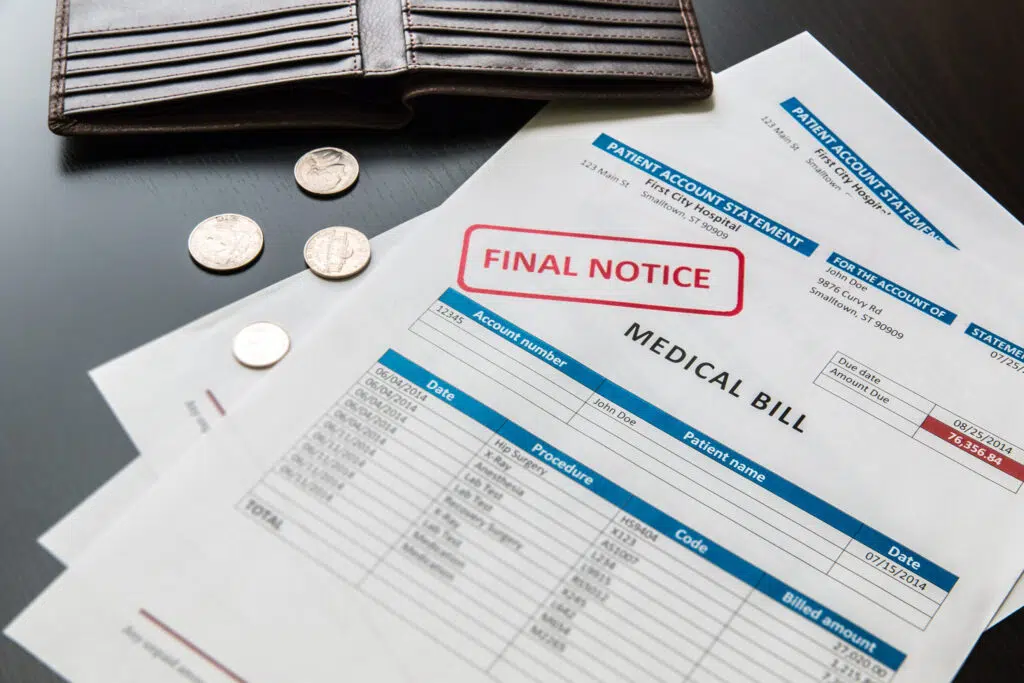

- Expect to receive bills for ambulance or hospital services by mail

Your medical bills will feature a section for insurance information. If insured, complete this section and return the bill without making a payment. Subsequently, the relevant city, county, or ambulance service will coordinate with your insurance provider to settle the bill, either in part or in full.

Medical Treatment

After receiving medical treatment, several actions should be undertaken during the waiting period to finalize your medical bills and process any insurance claims. To ensure a smooth process, the following steps are recommended:

Follow Your Doctor’s Orders

Following your doctor’s instructions is imperative for optimal recovery. Complying with their guidance not only facilitates your healing process but also bolsters your insurance claim, demonstrating your commitment to preventing further harm.

Strict adherence to any prescribed medical advice and follow-up treatments is far-reaching. This approach prevents insurance companies from disputing your claims on the grounds of negligence. Ignoring medical recommendations may give insurers grounds to assert that the injuries are not severe enough to justify compensation, undermining your claim.

Keep All Medical Receipts

It is essential to meticulously maintain detailed records of all medical treatments received, including every receipt and doctor’s note, without exception. These documents are not merely paperwork; they are crucial in the insurance claim process as concrete evidence of your medical expenses and the care you require. Additionally, it’s important to keep all receipts for any expenses directly related to the accident, such as transportation to medical facilities, medication, and any special equipment needed for recovery.

By preserving a comprehensive record of these financial outlays, you can accurately demonstrate to the insurance companies the significant financial impact the accident has had on your life, directly attributable to the actions of the at-fault driver. This thorough documentation will strengthen your case, ensuring that the insurance assessment reflects the true extent of your expenses and losses.

Track Insurance Documentation

Notify your insurance provider about the accident promptly, furnishing them with all gathered details, such as the police report, medical documents, and the insurance information of the other driver involved.

For documenting any bills related to accident expenses, meticulously note the essential information:

- The entity issuing the bill

- The specific services billed for

- The date on which the services were rendered

- The total amount due

By keeping track of these details, you can ensure that your insurance claim covers all necessary expenses and is processed efficiently. Additionally, it may be helpful to consult with an attorney specializing in personal injury cases. They can provide valuable insight and guidance on navigating the insurance claim process.

Who’s Responsible for Paying the Medical Bills?

The obligation to cover medical expenses resulting from a car accident is not uniform across the United States; it significantly varies depending on the state’s laws. In determining liability and deciding who is financially responsible for the medical costs incurred, states follow two classification systems. These systems are critical in shaping how financial obligations are assessed and allocated among the parties involved in an accident. Understanding these classifications is essential for navigating a car accident’s legal and financial aftermath.

In a No-Fault State

In states like Florida that follow a “no-fault” system, each driver’s insurance company is responsible for covering their own medical expenses regardless of who caused the accident. This means that even if you were not at fault for the accident, you would still need to use your own insurance to cover your medical bills.

Florida is recognized as a no-fault state, indicating that in the event of a car accident, all parties involved must file claims with their own insurance, irrespective of who caused the accident. Consequently, the subsequent auto insurance coverages provide for medical expenses, regardless of fault determination:

Personal Injury Protection (PIP) Coverage

This type of coverage is mandatory in Florida and covers up to $10,000 in medical expenses for injuries sustained in a car accident.

MedPay Coverage

This optional add-on to PIP coverage provides additional medical expense coverage beyond the $10,000 limit.

In an At-Fault State

An at-fault state like Georgia follows a different system, where the driver determined to be at fault for the accident is responsible for covering all medical expenses resulting from the accident. If you were not at fault for the accident, you could file a claim with the other driver’s insurance company to cover your medical bills.

Georgia operates under the at-fault insurance system. Victims must file a medical claim with the at-fault driver’s insurance to receive proper reimbursement, as at-fault liability insurance does not immediately cover medical bills. Consequently, those involved in the accident must rely on their health and auto insurance for initial financial coverage until they are reimbursed. Most at-fault states, including Georgia, mandate drivers to carry specific auto insurance coverage to address these liabilities.

Bodily Injury Coverage

This insurance coverage provides for expenses related to medical treatment of accident-related injuries and additional treatment or injury-related costs incurred by individuals injured in a car accident caused by the policyholder. Georgia mandates that drivers have a minimum coverage of $25,000 per individual injured in an accident, which must be maintained, with up to $50,000 available coverage per accident.

How Do My Medical Bills Get Paid?

Hospitals typically operate independently of third-party entities, such as car insurance companies. This operational model means that the initial financial responsibility falls squarely on the patient when it comes to medical bills. This arrangement requires the patient to cover the cost upfront, regardless of any pending settlements or claims with their insurance or third-party entities. Those injured in an accident typically fall into one of the following categories.

No Insurance

If you’re uninsured, you might have to pay out of pocket initially but could be compensated by the at-fault party’s insurance later, especially in at-fault states.

Auto Insurance

Whether you reside in an at-fault or no-fault insurance jurisdiction, auto insurance policies offer coverage to address expenses from injuries sustained in an accident, irrespective of fault. Such coverages generally come into play after your health insurance has been applied to the costs of needed medical treatments.

Health Insurance

For the initial payment of medical bills, your health insurance or medical benefits will cover the costs, which may require a copay or deductible. These out-of-pocket expenses can be reimbursed if included in your car insurance claim.

Medical Lien

Sometimes, healthcare providers may agree to a medical lien if insurance coverage is insufficient or pending. This means they’ll wait to be paid from the eventual settlement of your car accident claim.

Seeking Help From Car Accident Lawyers

A skilled car accident attorney plays a critical role in maneuvering through the intricacies of insurance claims, particularly in cases with contested fault or significant medical expenses. They offer guidance on managing medical liens and skillfully negotiate with insurance providers to secure the compensation you rightfully deserve.

Settlement of medical bills after an accident can be overwhelming, especially when dealing with injuries. Farah & Farah’s car accident attorneys are dedicated to facilitating a smooth and effective resolution with insurance companies, ensuring you receive the appropriate coverage. Contact us today for a free consultation.