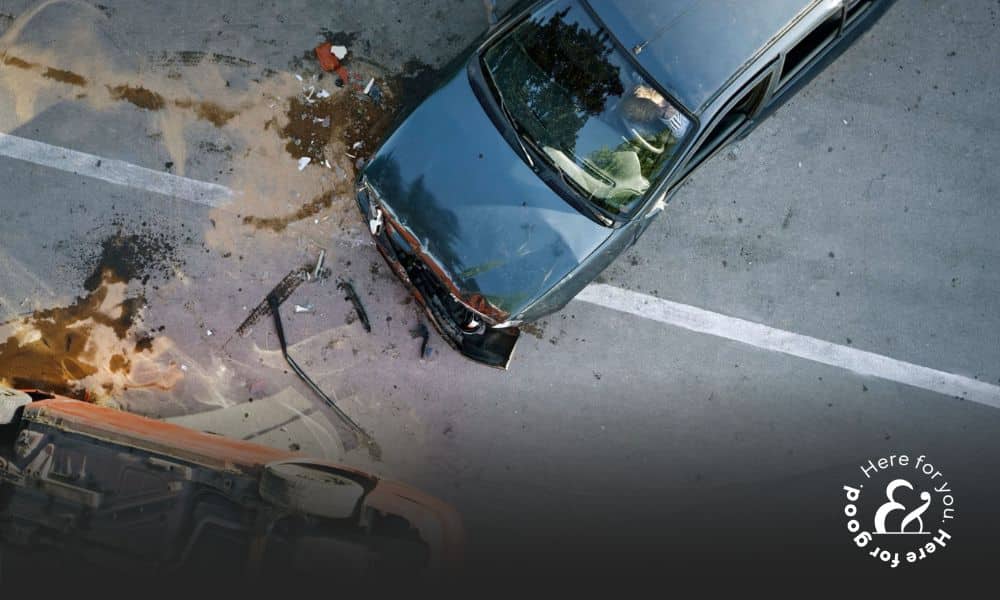

After an accident left no visible damage to our client’s vehicle, the insurance company didn’t think the crash could have possibly caused his injuries. With a complicated medical history compounding the questions in the case, our client needed answers. He was still in tremendous pain and seeking medical attention as he watched the bills pile up. That’s when he turned to accident attorney Rick Staggard.

We sat down with Rick to uncover the details of how he was able to prove the accident caused our client’s injuries and seek every avenue available to help him recover to the fullest.

How Do You Have Injuries When Your Car Isn’t Damaged?

With no visible property damage to our client’s vehicle and no police report filed, the insurance company representing the at-fault driver and our client’s carrier were incredulous. They couldn’t (or didn’t want to) believe that the crash could have caused the injuries he’d experienced. In cases like these, our team relies on the evidence in order to prove our client’s case.

Understanding Medical Records Is Crucial in Personal Injury Cases

In any case, there is a tremendous amount of work our team performs behind the scenes to bring all of the pieces together. Rick recalled doing a colossal amount of legwork leading up to the insurance companies finally coming to the table. “The insurance companies were pushing all the way to the trial date,” he explained. Part of the feat was the amount of work required using the medical records to prove that our clients injuries did, in fact, come from the crash.

Making the case more complicated was that he had prior back surgeries. However, a jury can also be sensitive to this fact, Rick explained. When someone has a major surgery that’s disrupted by an accident, the average juror can relate to just how terrible that must be.

By using the medical evidence to show that the crash had indeed aggravated previous injuries, Rick was able to bring the insurance companies to the table with concrete facts they’d otherwise have to fight in court. Just three weeks before the trial was set to begin, the insurance companies finally agreed to a settlement.

If you were injured in an accident due to someone else’s negligence, Farah & Farah is here for you. We’ve relentlessly fought for the right to compensation for our clients and their families since 1979.

Good Case Strategy Comes Down to Experience

With so much back and forth before the trial date, Rick had to use all of his experience to seek every available avenue for compensation. He first started by obtaining $750,000 from the at-fault driver’s commercial insurance for the work vehicle they were driving. Next, he was able to uncover additional coverage through our client’s own insurance through an underinsured motorist (UM) policy.

Taking this approach, Rick was able to secure two separate settlements in one case and maximize our client’s recovery. Having seen many cases through to victory in trials, Rick knows how a jury may react to certain elements of the case. He then carefully weaves together a strategy that always stays one step ahead. That strategy paid off in this case with $1,225,000 in total recoveries.

Insurance Saying Claim Denied? Talk to Us First

In this case, our client’s vehicle had no damage, yet he knew he was in serious pain after his accident. When insurance companies literally add insult to injury and deny a rightful claim, you can feel like you have no one to turn to.

If you’re tired of all the runaround and simply need an advocate, contact our attorneys and let us take over dealing with the insurance company. We’ll review your case for free and outline your options to move forward.